Mastering Trading with Ichimoku Kinko Hyo

Trading with Ichimoku Kinko Hyo: A Comprehensive Guide

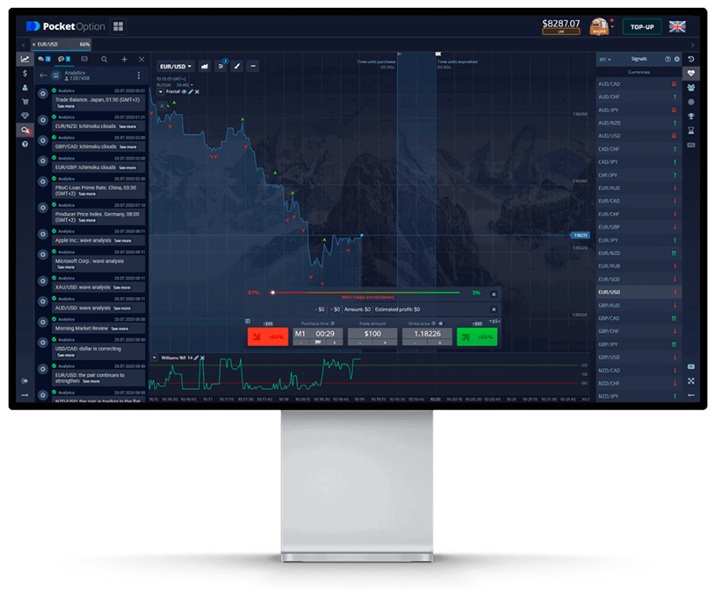

Trading with Ichimoku Kinko Hyo is a powerful method used by traders to analyze market conditions and make informed decisions. The Ichimoku Kinko Hyo indicator, which translates to “one glance equilibrium chart,” is a versatile and advanced indicator used primarily in forex trading but applicable to any financial market. Its comprehensive nature allows traders to gain insights into support, resistance, trend direction, and momentum. For those looking to deepen their understanding, detailed information can be found at

Trading with Ichimoku Kinko Hyo in Pocket Option https://trading-pocketoption.com/torgovlya-s-pomoshhyu-ichimoku-kinko-hyo-v-terminale-ot-pocket-option/.

Understanding the Components of Ichimoku Kinko Hyo

Ichimoku Kinko Hyo consists of five main components:

- Tenkan-sen (Conversion Line): This is calculated by averaging the highest high and the lowest low over the last 9 periods. It indicates short-term price movement.

- Kijun-sen (Base Line): This line averages the highest high and the lowest low over the last 26 periods and serves as a longer-term market trend indicator.

- Senko Span A: This is the average of the Tenkan-sen and Kijun-sen, plotted 26 periods into the future. It helps forecast future support/resistance levels.

- Senko Span B: Calculated over 52 periods, this line helps create the “Kumo” or cloud, which is a visual representation of potential support and resistance in the future.

- Chikou Span (Lagging Line): This line is the current closing price plotted 26 periods in the past. It helps in confirming trends and patterns.

How to Read the Ichimoku Cloud

The “cloud” formed between Senko Span A and Senko Span B is one of the most distinctive features of Ichimoku Kinko Hyo. The thickness of the cloud indicates market volatility, while the position of the price in relation to the cloud provides insights into potential bullish or bearish market conditions. If the price is above the cloud, the trend is generally considered upwards, whereas a price below the cloud indicates a downward trend. A trader can analyze the cloud color to gauge market momentum: the cloud shifts from green to red, indicating potential trend changes.

Trading Signals from Ichimoku Kinko Hyo

Ichimoku Kinko Hyo provides various trading signals:

- Buy Signal: When the Tenkan-sen crosses above the Kijun-sen, ideally occurring when the price is above the cloud.

- Sell Signal: A crossing of the Tenkan-sen below the Kijun-sen while the price is below the cloud.

- Cloud Breakouts: If the price breaks above the cloud, it signals a possible bullish trend; breaking below it suggests a possible bearish trend.

- Chikou Span Confirmation: This line should be above the price for buy signals and below the price for sell signals to confirm the trend.

Using Ichimoku Kinko Hyo in Different Time Frames

Ichimoku Kinko Hyo can be effectively utilized across various time frames, making it suitable for different trading styles such as day trading, swing trading, and long-term investing. Shorter time frames might produce more frequent signals but can also generate more noise, leading to false signals. On the other hand, longer time frames tend to create more reliable signals as they average out the volatility, providing a clearer trend direction. Traders should choose the time frame that best fits their trading style and risk tolerance.

Combining Ichimoku with Other Technical Indicators

While Ichimoku Kinko Hyo can stand alone as a trading system, combining it with other technical indicators can enhance trading decisions. For instance, using moving averages can provide additional confirmation of trend direction, while oscillators like the Relative Strength Index (RSI) can help identify overbought or oversold conditions. Moreover, volume indicators can be essential in validating price movements highlighted by Ichimoku signals.

Tips for Successful Ichimoku Trading

To optimize trading success using Ichimoku Kinko Hyo, consider the following tips:

- Practice Risk Management: Always set stop-loss orders to protect capital and determine your risk-reward ratio before entering trades.

- Stay Informed: Keep abreast of market news and events as they can impact price movements significantly.

- Backtest Strategies: Before applying any trading strategy live, backtest it on historical data to gauge its potential effectiveness.

- Focus on Multiple Time Frame Analysis: Analyze trends across different time frames to gain a better understanding of overall market sentiment.

Conclusion

Trading with Ichimoku Kinko Hyo offers a comprehensive approach to market analysis, combining various elements into one cohesive system. Whether you are a novice trader or an experienced one, understanding this powerful tool can significantly enhance your trading strategy. By mastering its components, signals, and applications, traders can make well-informed decisions and navigate the complexities of the financial markets with confidence. Remember, consistent practice and ongoing education are key to success in any trading endeavor.