Articles

Jared Mullane is a finance writer with over eight ages of expertise at the some of Australia’s biggest finance and you may consumer names. His specialties tend to be opportunity, lenders, private money and you can insurance coverage. Jared is actually qualified with a certification IV in the Financing and you will Financial Broking (FNS40821). Procrastinating on the paying billsGen Z (33%) is the generation most likely to help you procrastinate to your spending costs, if you are Boomers (17%) will be the really prompt with regards to paying off their fees. Such, in the June 2024, the new savings price was just 0.6%, an excellent stark evaluate so you can twenty-four.1% in the Summer 2020, when savings increased within the pandemic. This means a household making $twelve,100 thirty days inside the June 2024 manage conserve only $72, versus $dos,892 in the June 2020.

Flooding home values and you can ascending inventory control provided the new rise. A lot more Us citizens educated an increase in using unlike a growth inside the money inside 2022, according to the Federal Set aside’s review of the commercial really-becoming of U.S. households. Two-fifths, or 40%, from adults stated a boost in their loved ones’s month-to-month investing than the prior 12 months. Not surprisingly, members of the family proportions affects even if you reside income so you can paycheck.

Average internet well worth by generation

This was with 6-one year at the twenty-six% happy-gambler.com more and 3-half a year at the 13%. The brand new transfer of riches from generation to another is an intricate, multi-layered, mental feel. Mothers which struggled during the period of of numerous years tend to one day face their mortality and require to determine what it’ll create using their currency. Various other separate is anywhere between those with access to loved ones wide range and you can the individuals instead. It’s not purely regarding the intergenerational equity, it’s as well as intragenerational. However, while the an enthusiastic economist looking social equity, the newest injustice sensors had been ringing.

According to him it wasn’t effortless, but the guy made sacrifices to keep a deposit and you will secured inside a fixed rate out of 4.09 per cent in order to 2025 for peace of mind. “If the inflation remains above the Set aside Bank’s address, following we are going to require the cash price as really above the rising cost of living rates — which form a funds price better a lot more than 4 per cent,” he says. Nevertheless the focus on that financing is significantly down and therefore more than offsets the greater rates, Dr Tulip states. Dr Tulip, an excellent boomer himself, just who in the past did in the Set-aside Bank away from Australian continent plus the United states Government Set aside Board from Governors, states it is because home owners have larger debts, relative to both profits and you may property. The brand new consensus is the fact while every age bracket features encountered genuine fight, the nice Australian Imagine getting your home has become much more out of reach.

- To be honest, there’s plenty of nuance from the argument, because the each individual instance varies.

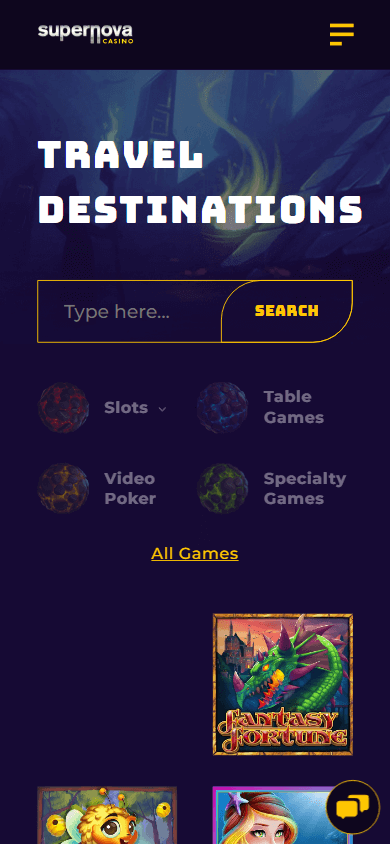

- The new gambling enterprise have a tendency to prefer and therefore video game be considered on the 100 percent free spins.

- One to day was not part of the delivery day however, removing cash away from you to shop would definitely conserve a good length of time.

Money Legislation So you can Unlearn and you will Update To enhance Their Money, Centered on a Gen Z Money Pro

In my opinion a lot of people that carried away on the removing dollars completely really want to get rid of ‘immoral’ items. So there is no facts that money deals are broadening. Pre COVID here had previously been many of these bucks Merely Western dinner inside northern Sydney. Whenever COVID repayments came in they couldn’t show their funds disperse and you may wound up shutting off. I spend that have credit wherever possible as well as the authorities has no a clue what i invest they on the.

HSBC International will bring a great cashback of 2% to the orders lower than $a hundred made due to a spigot-and-wade. In the event the banking companies can reduce its costs by reducing otherwise outsourced their Automatic teller machine community because of smaller bodily cash required, I do want to display when it comes to those savings. Who may have chasing after “bad debts” to have an enthusiastic EFTPOS deal of a savings account anyway? The remainder costs will be recouped by the billing ten% interest over the supposed rates to the charge card owner and therefore if the I’m not misleading is done today. Certainly one of my personal family members has numerous psychological state issues and only spends bucks.

The video game has colorful, in depth environment, simple animations, and you will sensible physics. The overall game offers a working soundtrack and sound pretending complimentary the online game’s make and you may temper. And therefore real time reputation will be as well as of a lot signs so you can manage an absolute combination.

Unclear exactly why you think VOIP goes into it, payment terminals avoid sound to run. Satellites are an access community tech not an excellent anchor technical (except away from final resort). Highest latency ‘s the consequence of point and more things within the the way to have study to take and pass in the for every assistance. The greater amount of ones you expose, the greater things you have got for research loss. Circle procedure can cost you never fundamentally fall into line for the cost of work in the said country. Their work as well as does not need to be located where your circle is situated getting rates max as well as is frequently best to not become.

But not, just what something can look such as 2034 — when Gen Zers have been in their very early 30s and you may, knock-on wood, preparing to end up being homeowners — are a completely some other matter. If you are seeking assume the fresh time from monetary cycles can be a trick’s errand, it’s tough never to see that the new long, booming data recovery America continues to be viewing should reach an prevent at some point. Should your economy flow from to have a recession next number of years, that will definitely ruin the work candidates of numerous newly finished people in Gen Z begin to come across work with 2026. Environment alter presents the chance that Gen Zers often deal with a keen economy in the middle of an emotional transition from fossil fuels.

The new quantity try a little some other if an individual takes on you to definitely enough time-name proper care insurance rates does not become more preferred, however the stark up development remains. Otherwise – I’m able to pick Really don’t should believe that risk of among those dastardly anything happening and take aside household insurance coverage. Next or no of them the unexpected happens, the danger might have been moved to a third party (the insurance coverage company) who’ll compensate me personally for my losings. Inside the synchronous, a corporate could possibly get decide to not undertake the risk of their EFTPOS terminals taking place and set inside redundant options, even when they only get utilized once or twice a seasons for a lot of instances. GOBankingRates works together of several monetary advertisers so you can reveal their products and you can services to your viewers. These brands compensate us to market their products or services inside the ads round the our very own site.

We all know one to approaching bucks prices are simple and you can minimal to own smaller businesses. Regarding the look at one cardholder, you would number what number of moments per month/seasons one to EFTPOS try not available because the a percentage of one’s matter of purchases they do monthly/seasons. We have not had one situation where it was not available in the past five years. If someone really worth use of the digital cash extremely sufficient following they’re going to make learning to make sure he has improved redundancy.

Boomers need the new Light House in order to prioritize Personal Defense money

Its prime best will be a part using some anyone to open up the brand new membership, no cash stored on the part and all sorts of organization looked after ATMs out top. Stephanie Steinberg might have been a reporter for more than a decade. Reports and you can Globe Declaration, level personal finance, financial advisers, handmade cards, senior years, paying, health and wellbeing and. She dependent The brand new Detroit Creating Space and you may Nyc Composing Room to provide creating classes and you can workshops for business owners, pros and publishers of all feel membership. The woman work has been authored from the New york Times, Usa Today, Boston Industry, CNN.com, Huffington Blog post, and you may Detroit publications. The value of the complete a property owned by baby boomers will probably be worth $18.09 trillion.

60 percent away from locations in it a first household value a median value of more $225,100000. Business guarantee is minimum well-known, nevertheless is apparently worthwhile, value an average amount of simply over $90,one hundred thousand. Other than riches, solid points regarding the chance you to a respondent has authored a will, tend to be possession within the opportunities such as companies, a home, carries, and bonds. They were actually healthier issues than which have dependent pupils, although the rates was intimate. While the house thinking improved, so contains the mediocre age people finding inheritances.

Where the only way about how to pay money for a good an excellent or provider would be to make use of the bucks you left available for merely a situation. However, Bullock said Linofox Armaguard got now shown the business try unsustainable since the cash use continued to fall. I’m ripped inside as the I really believe if you don’t feel the public transport card there has to be somehow to shell out.